Here is Part 2 of Deana’s

QuickBooks Best Practices Tips:

4. Data Input

One of the major challenges about maintaining accurate

QuickBooks records is keeping the information organized. When you have been in practice for a while

and have a long list of clients, it’s easy to get busy and backed up with correctly

organizing your records. Over time, renaming and adding accounts to your chart

of accounts may become a problem when your balance sheets and profit-loss

statements become difficult to read. As the balance sheet shows the practice’s

financial position.

- Importance of balance sheets

- Balance sheets shows your practice’s financial position at a single moment in time and also show a lifetime of results. It should always be accurate. Here is a helpful article on some QuickBooks balance sheet basics.

As far as keeping your records organize, always enter as

much detail as possible- its saves time later on if there is ever a discrepancy.

It’s always best to choose a quiet time or designate an hour or two without any

distractions to prevent any errors. Be sure to identify and correct any code

errors you catch in the system as this can affect your practice’s income. Simple

awareness of your funds can really have a positive impact on your bottom line.

- QuickBooks Tip

- With QuickBooks, regularly recurring transactions are saved and can be automatically entered at your regularly scheduled times. This reduces the amounts of mistakes, saves time and increases the accuracy of your bottom line.

5. Bank Feeds

A newer option for QuickBooks is the ability to

download the transactions right from the bank or credit-card company. This has

become a huge timesaver. Once the transaction has been coded it will be

memorized for future transaction download. Here are some instructions

on how to use the QuickBooks bank feeds in versions 2014 or later. - Options Available

- Downloading by Most recent transaction or by statement

- Banks now offers the option to download information into QuickBook

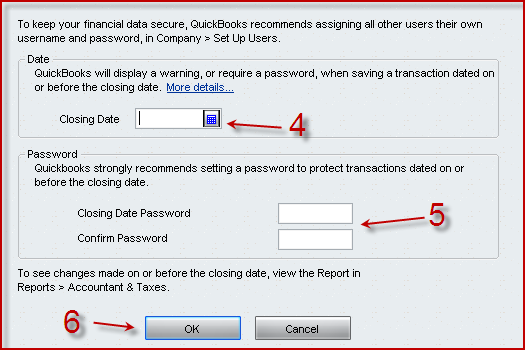

6. Lock Down

A common issue we see with our clients is entering or editing a transaction in prior periods. Whether intentionally or unintentionally, changing prior-period data can cause a huge mess with the books. Known to have driven many accountants crazy over the years, posting into prior periods can actually be controlled by using the closing date feature within QuickBooks. It’s easy to set up a unique username and password for each user's preferences to prohibit them from changing items once past the closing date. You can also lock down the prior-period date as the year progresses.

A common issue we see with our clients is entering or editing a transaction in prior periods. Whether intentionally or unintentionally, changing prior-period data can cause a huge mess with the books. Known to have driven many accountants crazy over the years, posting into prior periods can actually be controlled by using the closing date feature within QuickBooks. It’s easy to set up a unique username and password for each user's preferences to prohibit them from changing items once past the closing date. You can also lock down the prior-period date as the year progresses.

- Here is a screen shot:

Read the full instructions here.

7. Reporting

Another option for organizing information in QuickBooks is through

the applications’ memorized reporting function. This will save you the trouble

of having to re-create the reports every time you need to access them, it will

also make it easy for you to access these reports quickly. QuickBooks also

provides a feature called Process Multiple Reports, which enables users to

group together dozens of reports and print them in a single step.

- Take a look at these 11 tips to optimize Quickbooks reporting.

With QuickBooks, and a trusted Dental CPA on

your side, being organized and ensuring that your practice’s finances are

accurately managed is simple. Regardless of the size of your Dental practice,

you want to ensure that you are running your business efficiently by having

good bookkeeping and accounting practices.

Stay tuned for our 3rd

and final portion of this series on Ten Tips to Stay Organized and Efficient. You

can also check out Deana’s original Dentaltown article here.

For information on questions

specific to your practice’s accounting needs, contact Deana or reach out to any of our Dental CPAs

by emailing info@dentalcpas.com

No comments:

Post a Comment